WACC (Weighted Average Cost of Capital)

Introduction – WACC

Weighted Average Cost of Capital (WACC) is a crucial tool that helps businesses determine this cost by taking into account the cost of each type of financing and the proportion of each that makes up the company’s overall capital structure.

By calculating the WACC, businesses can make informed decisions about their investments and evaluate the profitability of their projects. In this article, we will delve deeper into the concept of WACC, explore how it is calculated, and examine its significance in the world of business and finance.

Inequality of investor rate of return and company cost of capital

Both investor required rate of return and the company cost of capital are not equal because the company received tax relief on the interest, e.g. for investment in debenture issued by the company @ 10% interest with corporate tax @ 30% has a rate of return for investor 10% but company cost of capital is 7% (10% x (1-30%) with is net of corporate tax of 30%.

Capital of the Company

Equity

The capital is raised through the issue of share capital to the company’s shareholders.

Debt

The capital is raised through investors by issuing bonds, and debentures against the rate of return.

Formula of Weighted Average Cost of Capital (WACC)

Where,

Ke = Cost of equity

Kd = Cost of debt

E = Market value of equity

D = Market value of debt

t = Corporate tax rate

1-t = After tax

Explanation of keywords used in Weighted Average Cost of Capital (WACC)

1) Cost of Equity (Ke)

It is the weighted average of the cost of equity (Ke) and it is denoted by Ke. cost of debt is denoted by Kd (1-t) i.e. after taxation.

How to calculate the cost of equity (Ke) in WACC formula

The cost of equity is calculated through a) Dividend Valuation Model or b) Capital Asset Pricing Model (CAPM)

a) Dividend Valuation Model (DVM) – Ke in WACC

The dividend Valuation model calculates the market value of shares by taking the present value of future dividends.

a (i) Dividend Valuation Model (DM) with no growth in dividend

When the company shows no growth in the dividend, the below formula is used;

Ke = Shareholders’ required to return in %

D = constant dividend from year 1 to infinity

Po =share price now at year zero (it is ex-dividend share price)

Example:

A company has paid Rs.2 dividend for many years, and the market value of the share is Rs.25. Calculate the cost of equity Ke.

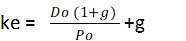

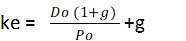

a (ii) Dividend Valuation Model (DM) Constant growth in dividend

When the company shows constant growth in the dividend, the below formula is used;

Where,

Ke = shareholders’ required return

Do (1+g) dividend at the end of year 1

g = constant rate of growth in dividends in %,

Po = share price now at year zero (it is ex-dividend share price)

Example:

A company has paid Rs. 2 dividends with a growth rate of 8% , and the market value of the share is Rs.25. Calculate the cost of equity Ke.

![]()

b) CAPITAL ASSET PRICING MODEL (CAPM) – Ke in WACC

Required return = Risk-free return + systematic risk premium

The Capital Asset Pricing Model (CAPM) is a financial model that helps investors and businesses calculate the expected return on investment for a given asset or portfolio. CAPM is based on the idea that an investor’s expected return on investment should be proportional to the risk involved in that investment, and it takes into account the asset’s expected return and the expected return of a risk-free investment.

Ra = Rf + (Rm – Rf) x Ba

Where,

- Ra = Required return

- Rf = Risk-free rate of return which is normally on government bills

- Rm = Average market return.

- Rm – Rf = Market risk premium, this is the reward that investors over and above investment in risk-free securities

- Ba = Systematic risk of security/shares

(2) Cost of Debt (Kd)

It is denoted by Kd (1-t) i.e. after taxation. cost of debt Kd (1-t). The weightings are the proportion of the market value of debt and equity. For instance, a company has a market value of equity of Rs.60 million and a market value of debt of Rs.40 million so weights shall be 60% equity and 40% debt.

How to calculate the cost of Debt Kd in WACC formula

Types of debts

2(i)(a) Kd in WACC Calculation for Irredeemable Fixed Rate Debt

Irredeemable means debt shall not be repaid and interest is paid in perpetuity.

Therefore, the market value of the debt is the present value of future interest discounted at Kd which is the rate of return of debt providers.

The formula of Kd for irredeemable fixed-rate debt

Where i = interest amount per debenture

Example:

A company has issued an irredeemable debenture at the market value of Rs.100 @12%. Calculate the required rate of return Kd.

![]()

2(i)(b) Kd in WACC calculation for Irredeemable fixed-rate debt after tax

The formula of Kd after tax

Example:

A company has Rs.30 million of debenture value on its balance sheet debt portion. The loan is irredeemable interest rate is 12%. Market value is Rs.90 per 100 debenture. The tax rate is 30%.

Calculate the market value of debt and cost of debt.

Solution:

Market value of debt = 30 million x = 90 / 100 = 27 million

Cost of debt :

![]()

2(ii) Kd in WACC calculation for Redeemable Fixed Rate Debt Kd in WACC

The redemption value is agreed upon at the time of issue and may be on discount or premium.

How to calculate the required return on debt Kd in WACC for redeemable Fixed Rate Debt

Kd shall be calculated by the Internal rate of return (IRR)

Where,

A% = discount rate where NPV is positive (lower discount rate)

B% = discount rate where NPV is negative (higher discount rate)

NPV a = NPV at discount rate A%

NPV b = NPV at discount rate B%

Example:

A company has issued 14% redeemable debt for 5 years. Redemption shall be at par value. The market value of the debt is Rs.107.17 . Calculate the investor-required rate of return. The tax rate is 30%

| Year | Cash Flows | Discount rate 10% | NPV at 10% | Discount rate 15% | NPV at 15% |

| 0 | (107.17) | 1 | (107.17) | 1 | (107.17) |

| 1 – 5 | 14 | 3.791 | 53.074 | 3.352 | 46.928 |

| 5 | 100 | 0.621 | 62.1 | 0.497 | 49.7 |

| 8.004 | (10.542) |

We shall first calculate the investor-required rate of return through IRR and then adjusted it with tax relief for the company so Kd after tax shall be 12.16 (1-0.30) = 8.512%.

3) Market Value of Debt

How to calculate the market value of redeemable fixed-rate debt Kd in WACC

Example:

A company has issued 14% redeemable debt for 5 years. Redemption shall be at par value. The investor-required rate of return is 12%. Calculate the current market value of the debt.

| Year | Cash flow discount | Discount 12% | Present value | Remarks | |

| 0 | Market value | 1 | (107.17) | Balancing figure | |

| 1-5 | Interest | 14 | 3.605 | 50.47 | Calculated |

| 5 | Redemption | 100 | 0.567 | 56.7 | Calculated |

| NPV | 0 |

The market value of the debt is Rs.107.17.

Conclusion – WACC

Understanding the Weighted Average Cost of Capital (WACC) concept is crucial for any business seeking to make informed investment decisions. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets, and it takes into account the cost of both debt and equity. By using WACC, a company can determine the minimum return it needs to earn to satisfy all its investors.

Calculating WACC can be a complex process, but it is a valuable tool that helps businesses evaluate their capital structure and determine the cost of financing. The WACC can also be used to determine the potential profitability of new projects and to compare the cost of capital to the expected returns on investment.

However, it is important to note that WACC is not a perfect tool and has its limitations. It assumes that the company’s capital structure remains constant, which may not always be the case, and it does not take into account other factors that may affect the cost of capital, such as market conditions and investor sentiment.

Overall, a thorough understanding of WACC is necessary for businesses to make informed decisions about their capital structure and investments. It is a useful tool that can help businesses evaluate their cost of capital and make more informed financial decisions.

Related Topics

No Comments