Internal Rate of Return (IRR)

Internal Rate of Return (IRR)

The internal rate of return (IRR) is another method investment appraisal other than Net Present Value (NPV). It is the discount rate which makes Net Present Value Zero.

The companies have their own target of rate of return on particular projects. If internal rate of return (IRR) is higher or equal to the project rate of return ascertained by the company then project is feasible and should be accepted. If internal rate of return (IRR)is lower than the project rate of return ascertained by the company then the project needs to be rejected.

How to calculate Internal rate of return (IRR)

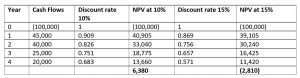

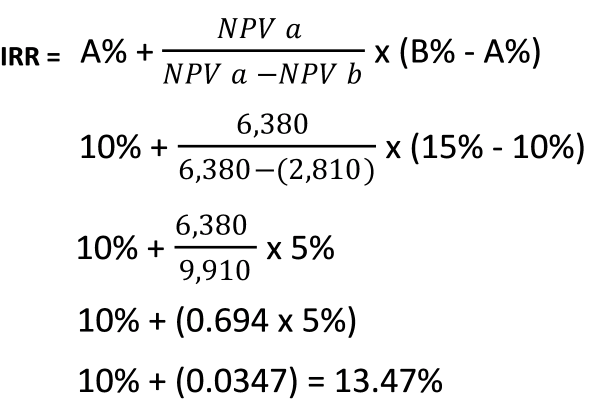

To estimate IRR, cash flows of the project are discounted using different discount rates. For getting more reliable IRR one NPV must be positive and another NPV must be negative.

When NPV at one discount rate is positive and NPV at another discount rate is negative then IRR shall fall between these two discount rates.

Example:

A company requires return on the project @ 12%. Below are the cash flows of the project, calculate IRR.

IRR = 13.47% , the project should be accepted as IRR is higher than required return on the project of 12%.

Advantages of IRR:

- It is easy to understand as it is return on investment in terms of percentage.

- It does not require cost of capital (ke) of the company only required return on the investment is necessary for comparison.

Dis-Advantages of IRR:

- As it is the return on investment in terms of percentage it may be misleading. For example IRR of 11% with investment of Rs.10,000 is higher than IRR of 10% with investment of Rs.10 million. As per percentage project of Rs.10,000 gives higher IRR but in value investment of Rs.10 million is much more feasible.

Related Articles:

Modified Internal Rate Of Return

No Comments