Earnings per Share (EPS) – IAS 33

Introduction

Earnings per Share (EPS) is an important concept of accounting. In this article we are covering below topics of EPS;

- Basic concept and formula of EPS

- Preference Shares treatment

- Issue of new shares

- Bonus Issue

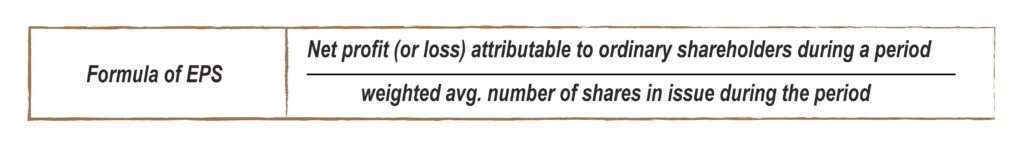

Basic Concept and formula of earnings per share

The rules for calculating Earnings per Share are defined in IAS 33.

It is very easy concept. The profit is adjusted with few items is divided by weighted average number of shares in the particular period.

Which Earnings shall be taken?

Earnings is the profit after deducting taxation (PAT).

Preference Shares:

EPS is a measure of earnings per ordinary shares.

Company has Preference Shares

These shares shall not be included in weighted average number of shares.

Preference shares classified in equity

The dividend on preference shares shall be deducted from the profit.

Preference shares classified in liabilities

If preference shares are classified in liabilities e.g. in the case of redeemable preference shares the finance cost already deducted from profit on arriving at profit after taxation (PAT). Hence, no further deductions shall be made.

Cumulative preference shares dividend shall be deducted from profit no matter declared or not. Non- cumulative preference shares shall only be deducted if the company declares it.

Concepts learning

What are cumulative and non-cumulative preference shares?

Cumulative preference shares concept:

If company fails to declare a cumulative preference share dividend in any period the dividend remains payable on the part of the company and shareholders are entitled to receive all the missed dividends.

Non-Cumulative preference shares concept:

The shareholders are entitled to receive non-cumulative preference share dividend only on declaration by the company. If a company fails to declare the dividend in any year then such dividend cannot be claimed by the shareholders.

Changes in Weighted Average Number of shares

During the period, there may be change in weighted average number of shares due to;

- Issue of new shares by the company

- Bonus Share Issue by the company

- Right Share issue by the company

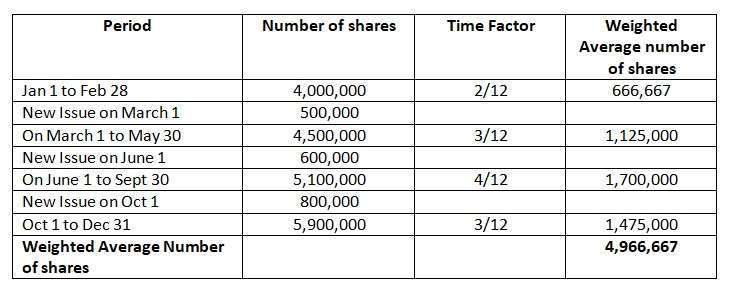

Issue of new shares:

A company can issue new shares to the shareholders, the impact of new issues on EPS can be studied via below simple example.

Example of issue of new shares:

– Jan 1 the company has 4,000,000 ordinary shares:

-March 1, 500,000 ordinary shares were issued

-June 1, 600,000 ordinary shares were issued

– Oct 1, 800,000 ordinary shares were issued

Calculation of weighted average number of shares:

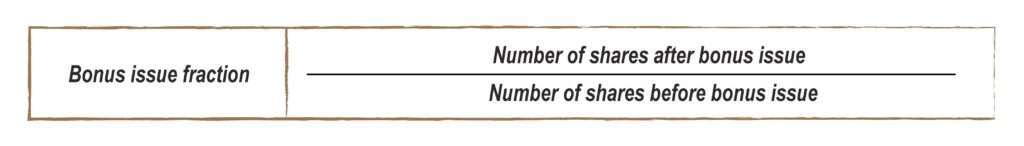

Bonus Share Issue

Bonus shares are issuance of new shares to existing shareholders. These are issued without any cash consideration from shareholders and are issued “free of cost”.

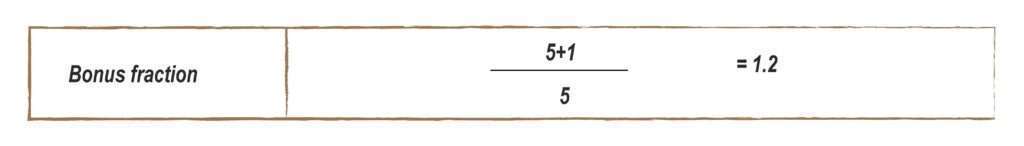

Example of bonus factor:

A company issues bonus shares at 1 share for every 5 shares held (20%):

When there is capital increase due to bonus share issue each preceding period must be multiplied by bonus factor

Example of bonus share issue:

A company has year-end of Dec 31.

On Jan 1, year 3 the company has 5,000,000 shares.

It issued 5 for 1 bonus shares on May 1

Earnings Year 3 Rs. 25,000,000

Earnings year 2 Rs. 20,000,000

Answer: Earnings per share of year 3 and year 2 (restated)

Bonus factor:

| Period | Number of shares | Time Factor | Bonus Factor | Weighted Average number of shares |

| Jan 1 to April 30 | 5,000,000 | 4/12 | 1.2 | 2,000,000 |

| New Issue on May 1 | 1,000,000 | |||

| On May 1 to Dec 31 | 6,000,000 | 8/12 | 4,000,000 | |

| Weighted Average Number of shares | 6,000,000 |

| EPS Year 3 | 25,000,000 | = 4.16 |

| 6,000,000 |

Comparative Earnings per share of year 2 shall be revised by multiplying EPS (Rs.4) of year 2 with reversal of bonus factor (5/ 6).

Actual EPS Year 2

| EPS Year 2 | 20,000,000 | = 4 |

| 5,000,000 |

Restated EPS Year 2

| Rs. 4 x 5/6 | =3.33 |

Right Share Issue

Right shares is the issue of new shares to the existing shareholders. The issue price is always less than current market price so there is bonus element which must be taken into account for calculation of weighted average number of shares, for this purpose right factor is calculated, the formula is as follows:

The complete concept of right issue can be understood through below example:

Example of Right share issue:

Company X had 4,000,000 shares on Jan 1 in year 3.

It issued 1 for 5 right issue on 1 May year 3, at the price of Rs.80 per share. The share price of the company before right issue is Rs.100.

Total earnings for year 3 is Rs.35,000,000. EPS for year 2 was Rs.7.5.

Answer:

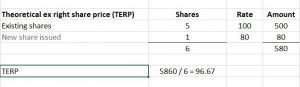

Right Issue Fraction= 100/96.67 = 1.034

| Period | Number of shares | Time Factor | Right Factor | Weighted Average number of shares |

| Jan 1 to April 30 | 4,000,000 | 4/12 | 1.034 | 1,378,666 |

| Issue of right shares | 800,000 | |||

| On May 1 to Dec 31 | 4,800,000 | 8/12 | 3,200,000 | |

| Weighted Average Number of shares | 4,578,666 |

| EPS Year 3 | 35,000,000 | = 7.64 |

| 4,578,666 |

Comparative EPS of year 2 shall be revised by multiplying EPS (Rs.7.5) with reversal of right factor (96.67/100).

Restated EPS Year 2

Rs.7.5 x 96.67 / 100 = Rs.7.25

About the Article:

The author searched the topic of EPS on internet and found only the formula of EPS or IAS 33 summary, so he feels that there is need to explain EPS in little bit detail with examples.

Audience:

The article is for students to learn basic concept of IAS 33 and for professionals so that they can revise the topic for usage in practical life.

Articles related to this topic:

Diluted Earning Per Share (EPS)

alphagull

February 26, 2021 at 12:31Thanks for sharing the informative article.

Ali Murtaza

March 1, 2021 at 21:16We appreciate your readings.