Accounting Rate Of Return (ARR)

Accounting Rate of Return (ARR)

Accounting rate of return (ARR) is the return on investment based on specific project. It is calculated by dividing accounting profit after depreciation but before interest and tax (PBIT) with average capital invested.

Formula of ARR

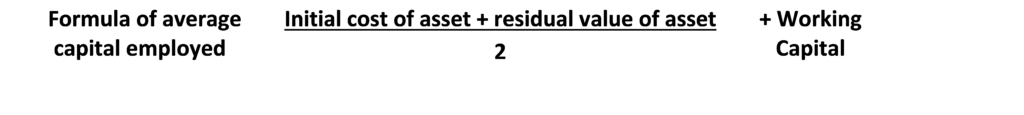

Average Capital Employed

Average capital employed is calculated by taking average of cost of asset and residual value of asset and then working capital is added.

Formula of Average Capital Employed

Example:

A company is considering a project which requires investment on the machinery amounted to Rs.150,000. The machinery life is four years having scrap value of Rs.30,000. Additional capital requirement for the project is Rs.20,000.

The expected project before depreciation are as follows:

-Y1 Rs.52,000

-Y2 Rs.55,000

-Y3 Rs.48,000

-Y4 Rs.27,000

The company requires ARR of 13% for the project.

Answer:

| Total Project Profit before depreciation | Rupees |

| Year 1 | 52,000 |

| Year 2 | 55,000 |

| Year 3 | 48,000 |

| Year 4 | 27,000 |

| Total Profit | 182,000 |

| Depreciation (150,000-30,000) | (120,000) |

| Profit after depreciation | 62,000 |

| Project Period (divide by 4 years) | 4 |

| Average accounting profit | 15,500 |

| Average capital employed (150,000+30000/2+20,000) | 110,000 |

| ARR (15,500 / 110,000) | 14.09% |

The return on the project as per ARR is 14.09% against company’s required return of 13%. The company should accept the project.

Advantages

- Easy to understand and easy to calculate.

Disadvantages

- It is based on accounting profit and not on cash flows.

- It ignores the time value of money

Audience:

The article is for students who wants to learn basic concept of accounting rate of return (ARR). It is helpful also for finance professionals who just want to revise this topic. The readers an understand the basic topic with the help of simple example and use the topic whenever needed for studies and in practical life.

Articles related to this topic:

No Comments